Closing a credit card can be a hassle, especially if you have to go through the time-consuming process of calling customer service. However, with Chase, there are several convenient ways to close your credit card account without having to pick up the phone.

Image: pointmetotheplane.boardingarea.com

Whether you want to streamline your finances, avoid paying annual fees, or simply part ways with an unused card, understanding the different options available will empower you to close your Chase credit card account swiftly and effortlessly.

Online Closure: Quick and Convenient

Chase offers a user-friendly online platform that allows you to close your credit card account in just a few simple steps:

- Log in to your Chase account.

- Navigate to the “Credit Cards” tab and select the card you wish to close.

- Click on the “Account Services” tab and choose “Close Account.”

- Review the account closure information and confirm your request.

Secure Messaging: A Private and Efficient Alternative

If you prefer not to handle sensitive account information online, Chase provides the option to close your credit card via secure messaging:

- Log in to your Chase account.

- Navigate to the “Messages” section within the “Customer Service” tab.

- Compose a new message and specify that you wish to close your credit card account.

- Include your account information and contact details.

- Review your message and send it to Chase.

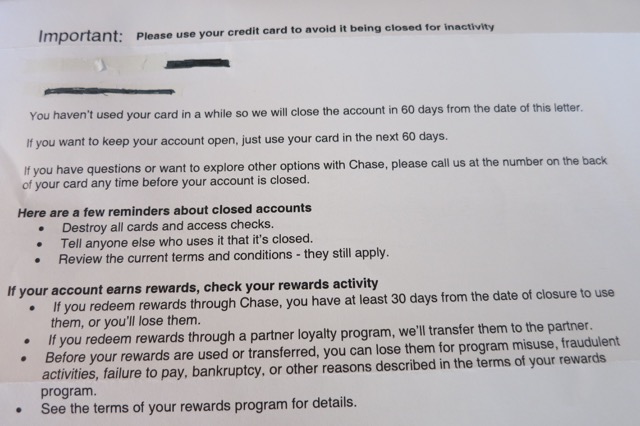

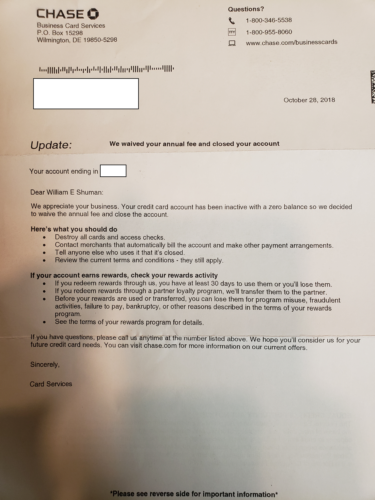

Mail Closure: A Traditional Yet Effective Method

For those who prefer a physical channel, Chase allows you to close your credit card account through the mail:

- Write a letter requesting the closure of your credit card account.

- Include your account number, personal information, and signature.

- Mail the letter to the following address:

Chase Card Services

P.O. Box 15220

Wilmington, DE 19850-5220

Image: pointmetotheplane.boardingarea.com

Things to Consider Before Closing Your Chase Credit Card

Before initiating the closure process, it’s essential to weigh the potential consequences:

- Credit Utilization Ratio: Closing a credit card can impact your credit utilization ratio, which is the percentage of your total available credit that you’re using. A higher utilization ratio can negatively affect your credit score.

- Credit History: Closing a credit card, especially one with a long history, can shorten your credit history, which is another factor considered in credit scoring.

- Card Benefits: Consider any rewards, perks, or benefits associated with your Chase credit card. Losing these benefits could outweigh the desire to close the account.

How To Close Chase Credit Card Without Calling

Conclusion

Whether you choose the online, secure messaging, or mail-based method, closing your Chase credit card account without calling is a simple and straightforward process. By understanding the available options and carefully considering the potential consequences, you can make an informed decision and close your account efficiently.

Remember to prioritize security by using Chase’s official channels and keeping your personal information confidential throughout the closure process. If you encounter any difficulties or have specific questions, don’t hesitate to contact Chase’s customer service for assistance.